DomesticLarge ModelThe identity of the startup’s main investor,TencentandAliOnce again standing in the position of "sugar daddy".

Since 2023, these two former major investors have coincidentally reduced their investment times significantly. According to Tianyancha public data, Tencent invested only 33 times in 2023, an average of less than 3 times per month. In 2021 and 2022, Tencent invested 302 and 91 times respectively. For details, please see the previous article of Hedgehog Commune. With more than 300 investments in a year, Tencent has become the "King of Fish" in the Internet.

But focusing on the field of large models, Tencent and Alibaba are the most "generous" investors in China. Earlier, Zhu Xiaohu, a well-known investor, said in an interview with Tencent Technology: "These (Chinese large model) companies have no scenarios and no data. What do you think is their value? And the valuation is so high at the beginning."

But obviously, Tencent and Alibaba don't think so.

Among the five currently known large-scale unicorn companies, Alibaba’s participation rate is as high as100%Tencent participated in the investment of 3 of them, with a participation rate of 60%. In contrast, Baidu and ByteDance have not invested in any of them so far.

Choice is the keyword that Internet giants most often face when the big model wave comes.

For those in power in the company, they have to choose whether to develop related businesses on their own, or whether to invest money in start-ups; for some senior executives, they have to choose whether to leave the soil of large companies and jump into the most imaginative entrepreneurial track in recent years; for ordinary employees, they have to choose whether to use their limited careers to bet on the bright future of new trends.

AT takes the lead, B waits and sees

A few years ago, a popular saying was that the AT in "BAT" is still Alibaba and Tencent, but the B has been replaced by ByteDance from Baidu. Some Baidu employees even publicly ridiculed themselves, saying that their company is not a big company, and used 1 degree (=Baidu's market value) as the unit to measure the market value of various Internet companies.

In this race to invest in big models, AT is still charging forward, while Baidu and Byte Dance have chosen to wait and see.

There are five large model companies in China with a current valuation of US$1 billion, namely Dark Side of the Moon, Zhipu AI, Minmax, Zero One Everything and Baichuan Intelligence. As mentioned above, Alibaba’s participation rate in these five companies is100%, Tencent invested in 3 companies except Dark Side of the Moon and Zero One Everything.

It is worth noting that neither Alibaba nor Tencent are the earliest investors in these five companies. Taking Zhipu AI, which has been established for the longest time, as an example, Alibaba joined in August 2023, and Ant Group became an investor in its B+++ round of financing. In the previous four years, Zhipu AI had experienced five rounds of financing.

The investment in Zhipu AI in August 2023 was also made by Alibaba’s investment institutionfirstAppears in the investor list of these five companies. If the scope is expanded from the current five unicorns to all large-scale startups, Alibaba’sfirstThe move took place in March 2023, when Ant Group participated in the incubation of Shengshu Technology, which focuses on the development of multimodal generative large models and application products.

When Ali'sFirstWhen the big model investment is completed, Alibaba's self-developed big model "Tongyi Qianwen" will soon be officially connected to DingTalk, and the independent APP will soon be open to the public.

Tencent's investment in Minimax occurred at almost the same time. In June 2023, Minimax completed a round A financing of over US$250 million. Public information shows that Tencent was the largest investor in this round.onlyInvestors. At that time, it was less than three months away from the official release of Tencent's self-developed Hunyuan Big Model application. In other words, in the process of developing its own big model, Tencent has also been looking for external investment targets.

From this perspective, Tencent and Alibaba have similar layout strategies for large models. Whether it is internal research or external investment, as long as there is hope, they will never miss any opportunity.

In the field of large-scale model investment, the "B" is on the sidelines, in contrast to the leading "AT". However, Baidu and ByteDance have different strategies.

Because it did not appear on the list of investors of any large-scale model unicorn, Baidu was once believed by the outside world to be all in on self-development in the field of large-scale models, betting all its resources and expectations on Wenxin Yiyan. But in fact, Baidu was another investor in the angel round of Shengshu Technology. When Alibaba turned to projects with higher valuations, Baidu participated in three rounds of financing for Shengshu Technology.

In terms of the number of projects, Baidu has invested in quite a few. From 2023 to date, Baidu has invested in big model-related projects including Shengshu Technology, Xihu Xinchen, Baiying Technology and Wuwen Xinqiong.From the comparison with Alibaba and Tencent, we can observe that Baidu does not invest in two areas in the field of large models: it does not invest in expensive ones, and it does not invest in general large language models (LLM).

The five unicorns mentioned above have current valuations of more than US$1 billion, and Baidu has not participated in the investment of any of them.

The four investment targets selected by Baidu are different from the Wenxin products developed by Baidu. Shengshu Technology mainly focuses on multimodal generative big models, Xinhu Xinchen mainly develops applications based on big models (such as AI writing and AI painting), Baiying Technology and Wuwen Xinqiong are both TO B businesses, the former mainly develops AI dialogue services and marketing systems for enterprises and government departments, and the latter mainly provides integrated hardware and software solutions for big models in vertical fields, which is to build infrastructure for big models.

Invest in applications, multimodality, and infrastructure, but not LLM. Judging from the results, this is Baidu's big model investment strategy based on the development status of its self-developed projects.At least, the leaders of Baidu's investment believe that in terms of the technical capabilities of the general big model, there is no external leader that is far superior to the Wenxin big model and is worth investing money in.

Compared with Baidu's wait-and-see attitude of "investing a little bit", ByteDance's wait-and-see attitude towards big model investment is more "strong". According to public information, ByteDance has not invested in any big model company. But "strong" can be understood as conservative, or it can be understood as radical in another sense - ByteDance has almost put all its chips on internal entrepreneurship.

There are countless tickets for the next era

When the target in front of you becomes the object of pursuit by everyone in the industry, why not to invest may be more difficult to answer than why to invest. Zhu Xiaohu is a pure investor, who only needs to look at the commercial returns of a single project, so he can naturally give a simpler and clearer logic. However, for large companies with complex businesses, there are more issues to consider.

What is important is not only "belief", but also position and stance.

ByteDance is not without its moments of excitement. LatePost reported: "ByteDance considered investing in large-scale model companies MiniMax and Step Star in the first half of 2023, but ultimately did not make a move." That was the time period when Tencent and Alibaba began to invest in large-scale models. In other words, ByteDance and these two companies once stood at the same crossroads, but ultimately chose another direction.

There may be two reasons why ByteDance made a different choice. One is the confidence in its self-development capabilities, especially the application layer product capabilities. In the past decade, ByteDance has created products that have a profound impact on users across the country and even around the world. The rapid development of its products and the agility of its product iterations have earned it the title of "App Factory".

The three favorable conditions of having money in the account, talent pool and rich R&D experience in the application layer may be one of the reasons why ByteDance made up its mind to focus on its own research and development since last year.

Since January 2023, ByteDance has formed multiple teams. At the model layer, it has successively developed the LLM large model Skylark and the multimodal large model BuboGPT. At the application layer, it has invested in the development of more than 10 products, some of which have been launched, while others are still in the confidential stage.

In order to better integrate resources, ByteDance established a new AI department, Flow, at the end of last year. The technical director is Hong Dingkun, ByteDance's vice president of technology, and Zhu Wenjia, the head of the big model team, is also the business director of Flow. Doubao, an AI conversation product that began testing in August 2023, has become a business line of its own and belongs to Flow. The other three business lines are AI education, internationalization, and community. For example, last monthup to dateThe released AI character interaction app Hualu belongs to the community business line under Flow.

According to Hedgehog Community, the flow team members are mainly composed of two parts. One part comes from internal transfers from ByteDance, and some members of the original Pico team, Douyin team, and Xigua Video team transferred to flow; the other part comes from external recruitment, and employees with experience in large-scale model products such as Baidu Wenxin Yiyan are the focus of external recruitment.

Another reason why ByteDance did not deploy a large model through overseas investment may be due to consideration of existing business needs.

Currently, the LLM large model project is still the main investment target on the market, but the integration between understanding text and generating text is not so close to ByteDance’s main business. Vincent audio and Vincent video are the technical capabilities that have a more far-reaching impact on ByteDance.

On the other hand, Tencent and Alibaba, which are relatively aggressive in investment, and Baidu, which is testing the waters with small projects, have relatively mature cloud service businesses. They rush into the market through investment in order to allow their own cloud businesses to gain more industry dividends as AI infrastructure. After all, Alibaba Cloud, Tencent Cloud, and Baidu Cloud are all among the top ten cloud servers in China.

But ByteDance has obviously not blocked the investment route. Its determination to go all in on self-research may be slightly shaken by the stunning success of its video product Sora and the rapid growth of Volcano Engine, ByteDance's cloud service platform.In the same report, it was mentioned lately: "Just recently, ByteDance once again contacted the leading large-scale model companies to re-evaluate the necessity of investment." The time point was in February of this year.

Everyone knows that AI is a ship sailing to the next era, but there are countless tickets. At least for now, no one can tell which ticket is real and which ticket will take people aboard the sinking ship.

"Do you have belief in the big model?"

Some people say that the investment of domestic large factories in large models is out of a kind of "FOMO" panic. That is the acronym for "fear of missing out". Although I don't understand why four English letters are used to replace "missing out", this is often the case in this industry.

Of course, no matter what the name is, the fear of "missing out" is completely understandable. The course of history has proved that it was not Google or Microsoft that created ChatGPT, but OpenAI; and it was not Alibaba, Tencent or Baidu that created TikTok. Being in it, it is hard not to feel anxious and wonder whether the ship bound for the next era is destined to set sail from a new dock.

The result of FOMO is that leading Internet companies have placed their chips on many ships through investment or self-research.

Some people also say that whether to invest or not depends entirely on whether the person in charge "has belief in the big model", just like the belief in mobile Internet, not the kind of belief that Chen Guilin wants to shoot one at a time.

In fact, it is not just the investment departments of large Internet companies that face choices, but also the executives and ordinary employees in the companies.

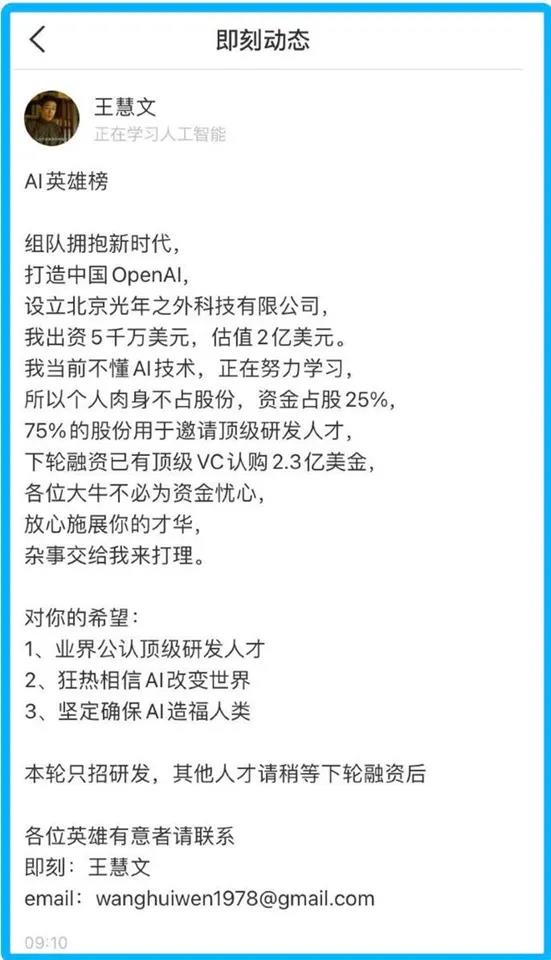

For example, Wang Huiwen, co-founder of Meituan, has already completed a round in the big model startup track. In February 2023, it was Wang Huiwen’s widely circulated “hero post” that kicked off the trend of executives of large companies entering the big model startup track.FirstBut four months later, Wang Huiwen temporarily withdrew due to personal health reasons, and Meituan acquired Lightyear for RMB 2.065 billion.

On April 2, 2024, Meituan CEO Wang Xing issued an internal email stating that Wang Huiwen would soon return and would serve as a consultant to Meituan part of the time, but did not disclose whether his specific business direction would still be related to AGI.

Over the past year, more executives from large companies have made similar choices.

According to statistics from technology media Zhidongxi, 14 executives from major companies have left their jobs to join AIGC, including three from Alibaba and Baidu, and the remaining eight from Microsoft, Meta, ByteDance, Didi, Meituan and other companies.

Company investment is buying possibilities with money. Executives of large companies bring their own resources and even funds to start a business, but ordinary employees who choose to invest in large-scale model startups mean gambling the stability of their careers on an opportunity for explosive growth. For ordinary employees, if they make the wrong choice, they will face higher risks.

An Internet industrySeniorEmployee comments: "This is different from ordinary job-hopping. If you used to work in information flow and then switch to another company to work on growth, the gap will not be that big. They are all businesses within the same system, and when you switch jobs next time, the business accumulation will be effective. But if you switch to work on large models, then there will be two systems. If you fail and come back, you will face more problems."

Therefore, from investors who are interested in big models to ordinary employees who are waiting for big model entrepreneurial opportunities, they all have to face the same question: "Do you have belief in big models?"

Within a large company, transferring to a department related to large models is a relatively safe option, because you don't have to leave the original large company environment, nor do you need to add a job-hopping record.

Faced with the "temptation" of new unicorns, many ordinary employees of large companies are still wavering. After completing a round A financing of over US$1 billion, Dark Side of the Moon published several job openings for growth products. A product manager who worked on growth at a large Internet company hesitated for a while and finally did not take action because she felt that "at this stage, there are very few things a PM can do."

But on the other side of the swingers, more people have already chosen to charge forward.

At the end of March, Dark Side of the Moon organized a movie-watching event. In the event group, many members from the Internet industry expressed their willingness to join Dark Side of the Moon. On the official recruitment website, the job requirements for growth products have been removed, which means that this big model star company has quickly recruited satisfactory members.