2023,AIIt's been a wild ride for a whole year.

Both technology giants and start-ups are exploring the potential of generative AI and developing their own AI products. According to Goldman Sachs data, global investment in AI will reach $200 billion by 2025.

Investors tend to look for new opportunities and new growth points in innovative fields such as AI.FamousVenture capitalist Aileen Lee once used the term "unicorn" to describe startups that were founded not long ago but are valued at over $1 billion.

The generative AI track has also produced many such "unicorns", which have demonstrated their extraordinary side in terms of financing capabilities, core products, and founding teams.

This year,Why did these companies receive a lot of investment and financing? In which AI directions are entrepreneurs working diligently? What capital is chasing after them?AI Enterprise?The top AI player has observed and referred to data such as the establishment time, investment and financing information provided by the official websites of various companies, Crunchbase, Qichacha, etc., and has taken stock of the AI companies that use artificial intelligence to conduct business and attract attention in 2023.

It should be noted that these companies are not all leading technology companies. Many of the companies on the list have been using artificial intelligence for product development as early as before the AI explosion in 2023. Some companies have won the favor of a large number of investors with their innovative applications and successfully squeezed into the ranks of AI unicorns.

Map:NUPD

Large models flourish, and multi-modal models have their own strengths

A company that has not started a large-scale model business in 2023 cannot be called a cutting-edge AI company.

Almost every other day, a new big model is officially announced in China, and a total of 238 big models were born in just 8 months. Among them, Alibaba, Huawei, ByteDance and other Internet giants have invested in big language models, and Baidu has even proposed an "All in AI" strategy.

Against this backdrop, a number of dark horse startups began to emerge in China, taking advantage of investors' enthusiasm to establish large-scale AI companies, such as Baichuan Intelligence, Minimax, and Zhipu AI.

Image source: Baichuan Intelligent official website

According to official data from Baichuan Intelligence, Baichuan Intelligenceup to dateThe total amount of a round of financing reached US$350 million, with investors including Alibaba, Tencent, Xiaomi, etc., becoming the largest domestic financing amountHighestVertical large-scale model manufacturers. Zhipu AI completed a financing of 2.5 billion yuan in October 2023, and Minimax has completed three rounds of financing with a valuation of approximately 2 billion US dollars.

Image source: Zhipiao AI official website

According to the Enterprise Business Card data report, China's AI field raised a total of 21.4 billion yuan in 2023, and the financing amount of the above three startups accounted for more than 30%.

In addition to the huge amount of financing and valuations exceeding US$1 billion, these companies also have star founding teams behind them.With skills, connections, and stable traffic, he gained continued attention.

Under the wave of generative AI, many unicorns with a valuation of more than US$1 billion have emerged abroad. They have created their own world with the help of AI tools.

Midjourney, a leader in AI painting, has released an image tool that runs entirely on the Discord platform, despite refusing to raise funding.

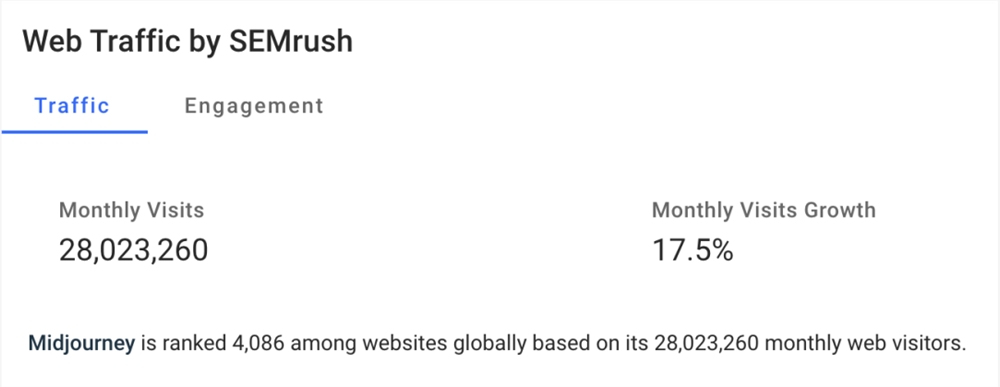

Image source: Crunchbase; Midjourney monthly visits

It relies on a subscription payment model, with annual revenue of $100 million and more than 10 million stable users.

After Midjourney, many entrepreneurs began to develop AI painting technology, and many companies followed suit. These include unicorns like Stability AI, which is valued at nearly $4 billion, and startups like StockAI, which was founded only four months ago and collapsed in the AIGC wave.

The second half of 2023 is known as the first year of AI video. While everyone is still surprised by the field of graphic design, graphic design companies are beginning to dazzle people, such as Runway, Pika, Synthesia, Tavus and so on.

Pika has raised $55 million in funding from investors including Quora CEO Adam D'angelo and Hugging Face co-founder Clem Delangue.

"The No. 1 AI Player" once introduced Pika in detail. The combination of multiple factors has created the myth of Pika's popularity. The AI video company that is often compared with Pika is Runway.

Runway is actually one of the creators of the open source software Stable Diffusion. With its strong technical strength, Runway completed a round D financing of at least $100 million in May this year, which made its valuation jump to $1.5 billion.

On the other hand, two other video generation companies, Tavus and Synthesia, are also worth paying attention to. Tavus has won the favor of Silicon Valley investment institutions such as Sequoia Capital and Y Combinator with its generated video solutions.

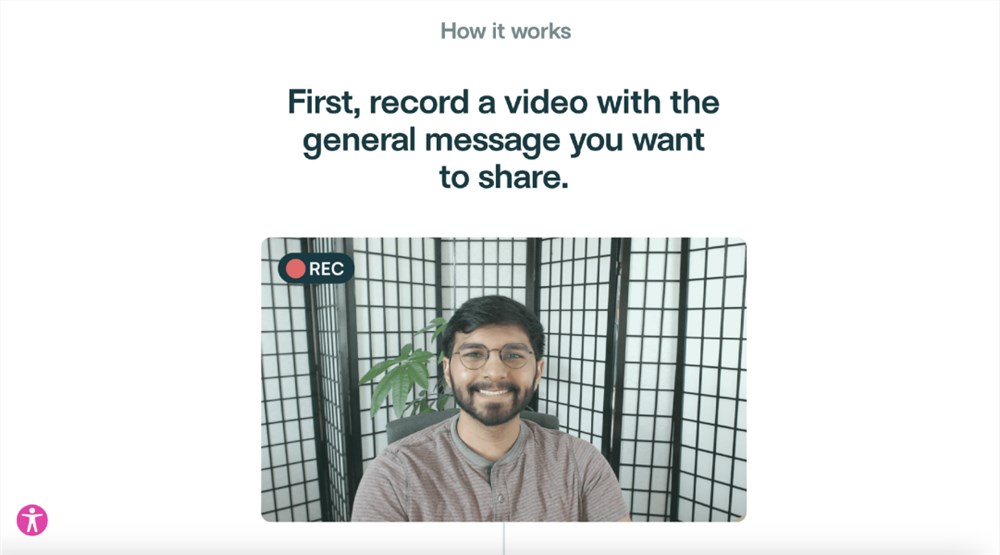

Image source: Tavus official website

A wide range of application scenarios is one of the main reasons for Tavus' success.Users only need to record a simple video, and Tavus can create thousands of video versions based on the template, tailoring the video for specific audiences. In this way, Tavus can serve customers in marketing, sales, recruitment and other fields.

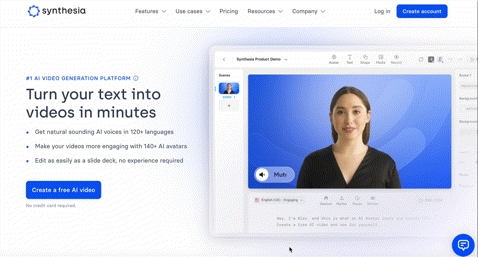

Synthesia once successfully became popular with a "Beckham's public welfare video". Its products allow users to make videos like making PPTs, and generate their own AI Avatar, the familiar "digital human", with one click.

AI digital humans can be said to be the traffic code in the video field. An AI investor once mentioned that this year, only digital humans made money in the AI track. Although the statement is a bit exaggerated, it still highlights the commercial value behind AI digital humans.

Synthesia, which focuses on the field of digital humans, has completed its C round of financing, with a market valuation of US$1 billion. Synthesia's CEO once revealed that "the company is currently maintaining triple-digit growth."

"Overseas Unicorn" once estimated Synthesia's revenue. According to the data disclosed by the CEO, Synthesia's annual revenue is approximately US$100 million.

Enterprises' layout of large models and their multimodal AI continue to be popular, and the investment market also believes that multimodal AI will bring more possibilities and become the only way to achieve general artificial intelligence.

nosuperAI is not affordable, but personalized AI is more cost-effective

What is the future of generative AI for AI companies?superDoes AI cover all user needs, or does personalized AI solve diverse needs?The AI direction they are planning may be the answer.

ChatGPT was launched on November 30, 2022. In just over a year, OpenAI has become an AI company with an annual revenue of over 1.6 billion.

This year, OpenAI has more competitors.

In February 2023, Anthropic released a ChatGPT-like product called Claude and made it available to users for free.

Claude official website homepage

In September 2023, Amazon announced a $4 billion investment in Anthropic. In October, Google said it would invest an additional $2 billion in it, and Anthropic's post-investment valuation reached $30 billion.

Currently, Anthropic is setting its sights on buildingStrongestThe largest AI company "Claude Next" is expected to raise $5 billion in new financing in the future.

In addition to Anthropic, chatbots similar to ChatGPT have also begun to emerge frequently. Although they are not as popular as ChatGPT, they have also attracted some attention, such as Inflection, Character.ai, and the rising star X.ai.

Inflection AI aims to be an AI product that provides emotional companionship. It defines its robot Pi as "amiable and kind", taking on emotional roles such as friends, confidants, and lovers in the process of communication.

Inflection's product Pi

Since its establishment in 2022, Inflection AI has receivedTopWith investments from venture capital firms such as Greylock, Microsoft, and Meta, Inflection has been valued at $4 billion, making it the third most valuable AI startup in the world, after OpenAI and Anthropic.

However, it is worth mentioning that the three founders of Inflection are Mustafa Suleyman, co-founder of DeepMind, Reid Hoffman, partner of Greylock Fund, and Karen Simonyan, who was once a member of DeepMind.Seniorthe scientist.

With such a founding lineup, it is not surprising that it attracts a lot of investment.

At the end of November 2023, Inflection completed the training of the Inflection-2 model, and its evaluation performance was second only to GPT-4, making it the second largest language model at present.

Chatbots are one of the most promising and popular areas in all AI fields. In addition to mature underlying technologies, many AI companies are targeting the core of "companionship", positioning their products in emotional care, and creating real-time responsive chat partners for users.

Character.ai has created a virtual chatbot and has been valued at $1 billion with zero revenue. According to a report by Sequoia Capital, Character.ai’s products are user engagementHighestOne, has grown to 15 million registered users since launching its subscription model in September.

In China, Minimax's layout in the To C field is AI virtual chat social software. After Glow, Minimax launched the AI role-playing product Talkie and the generative AI dialogue application Inspo, which attracted investments from companies such as Tencent and Mihoyo.

Talkie product page

Another company that focuses on personalized AI products is Xihu Xinchen. The company aims to create AI companions to accompany 1 billion people. Their "Liaohui Xiaotian" AI psychological healing robot has accumulated more than two million C-end users.

AIGC entrepreneur Liu Xin proposed thatAI role-playing may be the most promising track in the AIGC era, and of course it also refers to the "money" prospects.

The next development direction of the big model recognized by the industry is personalization and scenario-based. According to the observation of the "No. 1 AI player", many companies also hope that their products can be personalized, understand user needs, and have long memory capabilities. This is also the direction they will continue to work hard in the future.

AI companies also pay attention to "vertical entry"

AI companies in vertical fields are also accelerating their development. According to a previous report by Information, Harvey, which sells AI legal software, has only been established for one year, and its valuation has increased more than four times to US$700 million.

Investors also value the company's ability to make money.According to Crunchbase statistics, Harvey's annual recurring revenue (ARR) is approximately US$10 million, and it has a large number of large corporate clients such as PwC and Sequoia.

In addition to Harvey, a number of companies in vertical fields are favored and growing rapidly.

Scale AI, a company that focuses on data annotation, helps customers convert raw data into training data for developing artificial intelligence applications. It is expected that by 2024, Scale AI's potential market share will reach US$20 billion.

Image source: Scale AI official website

Glean, which is committed to developing enterprise-level search software, was founded in 2019. Its CEO comes from the Google search team and has extensive experience in search products. The enterprise-level AI search track has become a new outlet.

The firstMistral AI, the company behind the open source MoE model Mixtral8x7B, successfully raised $113 million with just a few PPTs.up to dateThe valuation is 2 billion US dollars. Many AI giants have published articles on the X platform to analyze that the open source of the MoE model represents a new direction for future enterprise open source AI, which is completely different from the model of OpenAI.

Mistral AI’s open source approach

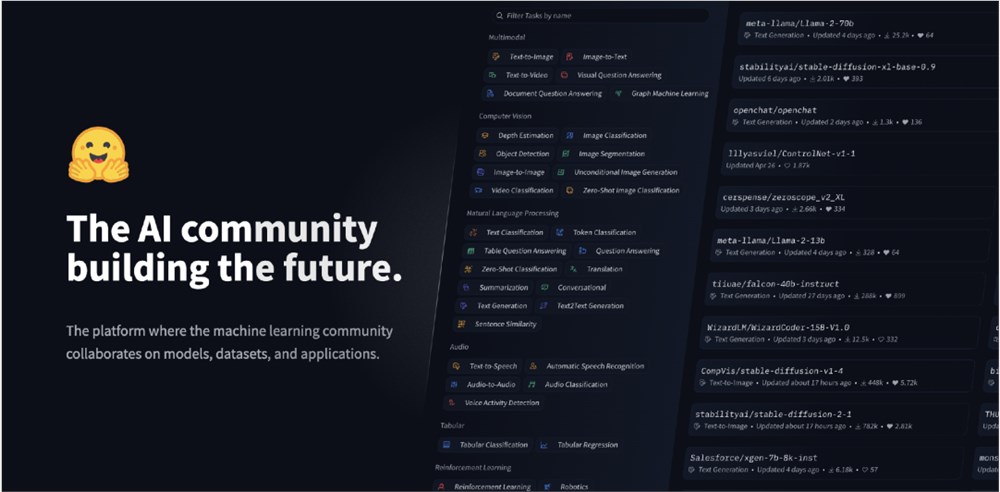

There is also Hugging Face, which is known as the creativity center in the field of AI. In 2023, more than 5,000 companies and organizations published content in the Hugging Face community and shared more than 100,000 pre-trained models. In May 2023, HuggingFace announced a financing of US$100 million, with a valuation of US$2 billion.

There are many companies worth paying attention to in the vertical fields, such as Helsing, which focuses on AI national defense, Xueersi, which is in the AI education track, and BioGeometry, which is planning AI medical care.

"In what areas do companies need to accumulate data, and which data are more valuable to users, including accumulation in user needs and scenarios, etc." said Du Lei, an early Silicon Valley VC. This is also the key to successful financing for generative AI companies.

In the past year, more and more entrepreneurs have realized the value that AI brings to individuals and businesses.

In general, the companies that enter AIGC have common success factors.With a strong founding team, strong technical expertise and innovative application direction, and in 2023 it was welcomed by investors and users.

As Huang Renxun said, AI is an urgent need for a company.Artificial intelligence is revolutionizing not only the way we design products, but also the products we make.

In the future, we will continue to see the emergence of new ideas and the creation of entirely new AI markets.