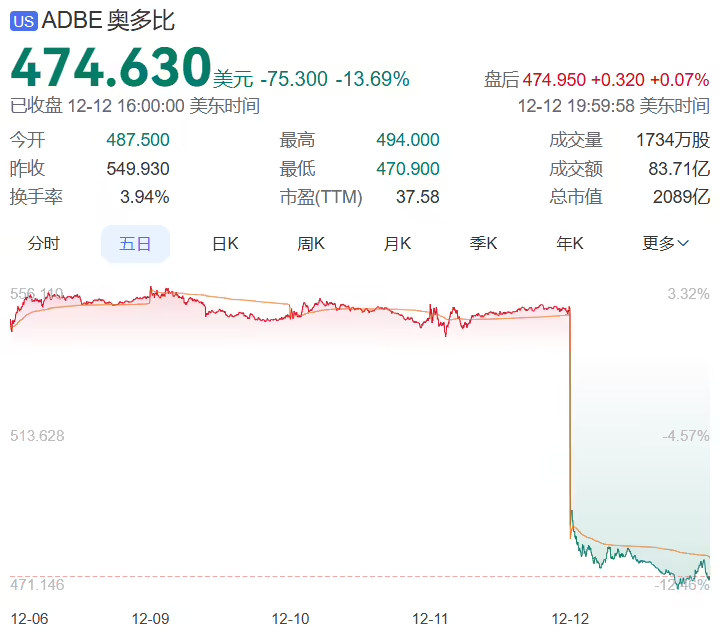

Adobe equity priceLocal time fell on Thursday 14%.Largest drop since September 2022, after the software vendor issued disappointing revenue guidance.

Adobe said in its earnings report released on Wednesday local time that it expects sales for the first fiscal quarter of 2025 to be in the range of $5.63 billion to $5.68 billion (currently around Rs. 40,948 million to Rs. 41,312 million). Analysts on average had expected revenue of $5.73 billion (currently about CNY41.676 billion), according to LSEG.

Analysts at TD Cowen downgraded the stock to "hold" from "buy," while Wells Fargo maintained a "buy" rating after calling the company a "depressing 2024". maintained a "buy" rating. The stock is down 20% this year.Lagging badly behind the NasdaqThe latter rose 33% and crossed the 20,000-point mark for the first time on Wednesday local time.

whose weak outlook has sparked investor concerns that the company's AI tools aren't paying off fast enough, according to Bloomberg.Unable to fend off growing competition from other generative AI software makers.