WSJ Exclusive.MicrosoftPositive andOpenAIMaking $14 billion in investmentsshareholdingsNegotiation.

In addition to equity, Microsoft, as the largest shareholder of OpenAI, how much actual control it has in terms of corporate governance and development after the transition is also the focus of the negotiations. Especially after Microsoft withdrew from OpenAI's board of directors, the whole negotiation process was very complicated and cumbersome.

To better clarify these, both sides brought financial negotiators into the room, with Microsoft going to Morgan Stanley and OpenAI to Goldman Sachs.

The Wall Street Journal said, Equity allocation is the toughest challenge in OpenAI's transition from a nonprofit to a for-profit company, and it's a high-stakes negotiation. If OpenAI gives Microsoft too much equity, it will not only change the competitive landscape of the AI track, but also cause strict investigations by antitrust regulators in the United States and the European Union.

In fact, it was because of the antitrust investigation that Microsoft withdrew from the OpenAI board. Regulators were concerned that by controlling OpenAI's technology and resources, Microsoft could create an unfair advantage in the AI market that would crowd out smaller and emerging competitors.

Meanwhile Microsoft's partnership with OpenAI has given it access to a large amount of OpenAI's user data, causing data privacy and user rights concerns. In many countries and regions, data protection regulations are becoming more stringent, and any potential violation of user privacy could be heavily regulated.

In addition, Microsoft's large stake in OpenAI could also affect the diversity and speed of technological innovation. If Microsoft has too much control in OpenAI, it may limit the exploration and innovation of other companies and research organizations in the field of AI, thus slowing down the technological progress of the industry as a whole.

So, in order to deal with a range of potential regulatory rules, OpenAI needs to give Microsoft a reasonable amount of equity and control without triggering a complex set of regulatory premises.

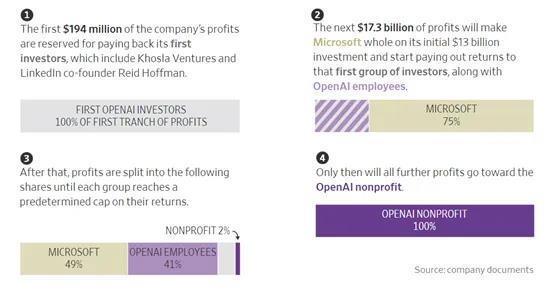

at present,While OpenAI's annual revenue exceeds $3 billion, its profits are largely used to pay back investors:...The first $194 million received was used to repay its earliest investors, Khosla Ventures and LinkedIn co-founder Reid Hoffman.

The next $17.3 billion in profits was used to pay back Microsoft, OpenAI employees, and early investors; then OpenAI's profits continued to be paid to Microsoft and OpenAI employees until specific metrics were met.

Only after the above three conditions are met will OpenAI's profit-making funds belong to itself, so OpenAI's transformation into a for-profit company is also due to enormous financial pressure. If OpenAI doesn't pay off its debts, it won't be able to share in the profits, and it will be burdened with these debts for a long time.

And OpenAI, in its recent $6.6 billion investment by Thrive Capital, NVIDIA, Microsoft, SoftBank, and othersThese investment organizations demanded that OpenAI needed to transform itself into a for-profit company within two years or they would demand that OpenAI repay all of its investments.

Since 2019, Microsoft has invested a significant amount of money into OpenAI, including the latest round of $6.6 billion in financing. That $1 billion investment in 2019 in particular was critical.

Musk had just left OpenAI and stopped all funding, leaving OpenAI on the verge of bankruptcy and unable to even pay its employees.

It was Microsoft's $1 billion that pulled OpenAI back to life and death, and had the funds to develop what would become the GPT-3 model.

It can be said that without Microsoft there would be no OpenAI today, and probably not a series of phenomenal generative AI products such as ChatGPT.