Sequoia CapitalSequoia Capital analyst David Cahn released a report saying AI IndustryThe bubble intensified.The annual output value must exceed 600 billion US dollars to pay for AI infrastructure such as data centers and accelerated GPU cards.

Nvidia's data center hardware revenue will reach $47.5 billion in 2023 (most of which is computing GPUs for AI and HPC applications).

In addition, AWS, Google, Meta, Microsoft and other companies also invested heavily in AI in 2023. Kahn believes that these investments will be difficult to recover in the short term.

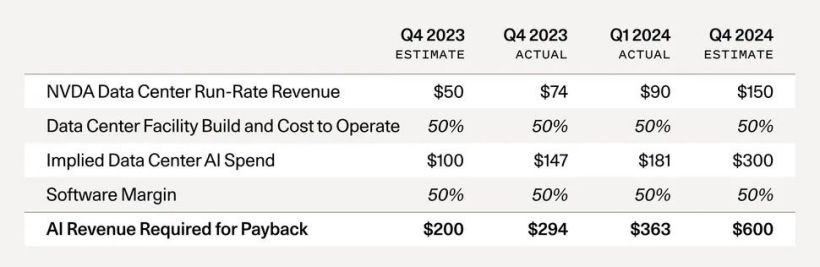

Kahn only made a rough estimate of the cost of running AI, first doubling Nvidia's run-rate revenue forecast and calculating the total cost of paying for an AI data center (GPUs account for half, and the other half is energy, buildings and backup generators).

This number is then multiplied by two to represent the fees paid by the end user, such as startups or enterprises purchasing AI computing from companies such as AWS, Microsoft Azure, etc.

According to the analyst, OpenAI, which uses Microsoft Azure infrastructure, sees revenue grow significantly, from $1.6 billion by the end of 2023 to $3.4 billion in 2024. The growth highlights OpenAI's dominance in the market, far surpassing other startups that are still struggling to reach the $100 million revenue mark.

Analysts ultimately believe that AI companies need to earn $600 billion (currently about 4.37 trillion yuan) per year to pay for the massive hardware expenses. Analysts believe that Google, Microsoft, Apple, and Meta each have annual revenues of around $10 billion, while other companies such as Oracle, ByteDance, Alibaba, Tencent, X, and Tesla have annual revenues of $5 billion, but there is still a gap of $500 billion, and they believe that the bubble in the AI industry is intensifying.