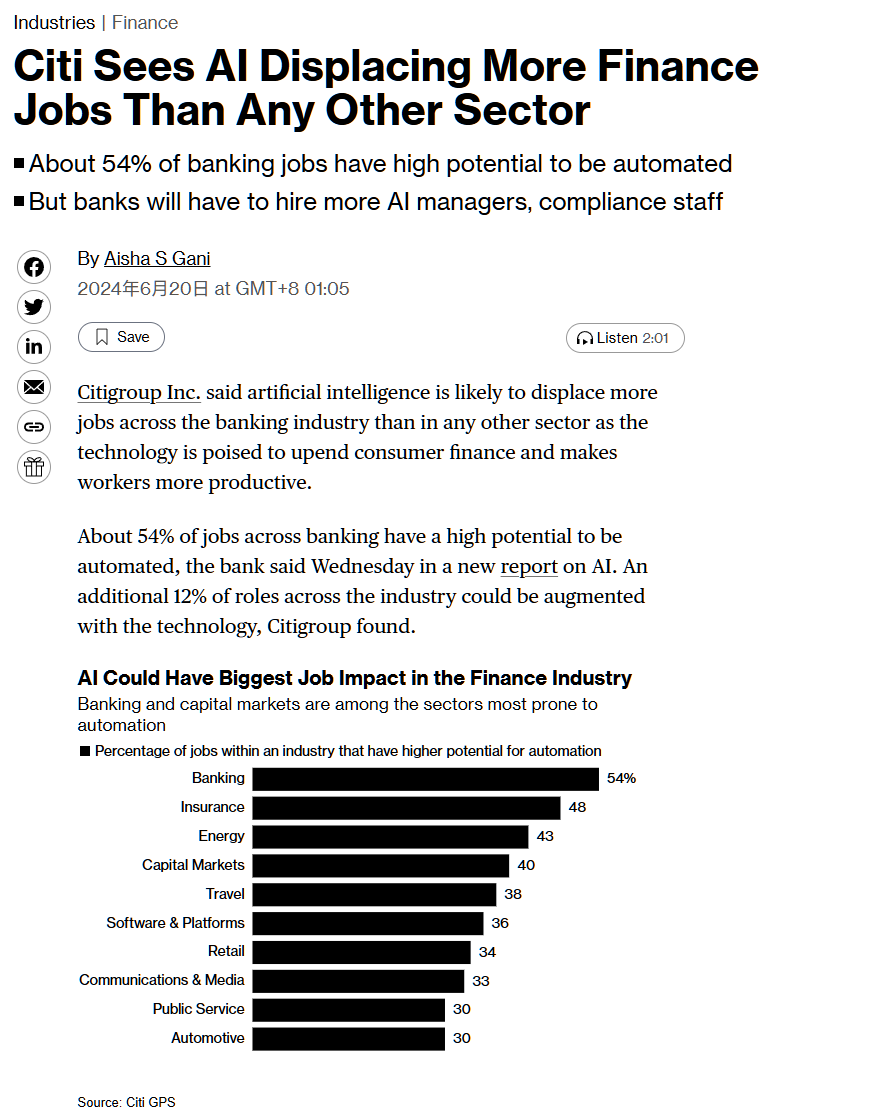

According to Bloomberg,Citigroup Inc.A new report on AI was released on Wednesday local time, and the data shows thatbankAbout 54% jobs in the industry will potentially be automated.

Citigroup says AI could replace banking jobslikelihoodMore than any other industry, because AI will disrupt consumers at the financial level and improve employee work efficiency. At the same time, 12% positions in the banking industry will be enhanced by AI.

Since last year, major banks around the world have been gradually trying to embrace AI, as it is expected to help them toIncrease employee productivity and reduce costs. Citi is no exception, having said it will bring the ability to experiment with different AI technologies to its 40,000 employees, and is already using generative AI technology to quickly navigate thehundreds of pagesof regulatory proposals.

Jamie Dimon, CEO of JPMorgan Chase, also expressed his belief that AI could enable employers to reduce the work week to 3.5 days.

David Griffiths, Citi's chief technology officer, said in the report's accompanying article that generative AI Could revolutionize the banking industry, and improve profitability. "At Citi, we are focused on using AI in a safe and responsible way to empower Citi and our employees."

Citigroup also said that even if AI does replace certain roles in the industry, the technology may not lead to a reduction in the number of employees. That's because financial firms will still likely need to hire a lot of AI manager or AI-focused compliance officerIn addition, new technologies have not always led to layoffs. In addition, new technology does not always lead to layoffs, as in the 1970s to the mid-1900s, when banks introduced ATMs while the number of human tellers still proliferated.

A professional within the bank once said thatSoon-to-be junior Wall Street analysts risk losing their jobs to artificial intelligence. Insiders at Goldman Sachs, JPMorgan Chase and several other big banks have made this assertion.