According to reports,AmazonIts cloud computing division AWS has suspended ordersNvidiaThe most advanced "superchip”Grace Hopper, waiting for the new, more powerful product, Grace Blackwell (GH200). The move comes as investors worry that Nvidia will see a demand slump between two product cycles.

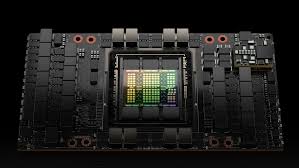

In March, Nvidia released a new generation of processors called Blackwell, less than a year after its predecessor, Hopper, began shipping to customers. Nvidia CEO Jensen Huang said the new product will double its ability to train large language models.

Grace Hopper was officially launched in August this year. AWS also confirmed the news to the media, saying that the time interval between the two products was short and it was reasonable to wait for the new product.

Nvidia declined to comment before releasing its quarterly earnings report on Wednesday, citing quiet period rules. Nvidia's stock price fell by about 11% in early trading on Tuesday.

Analysts expect Nvidia’s sales to triple in the quarter, driven by big tech companies’ heavy investments in artificial intelligence technology. But some investors have begun to question how long the extraordinary growth can last.

Morgan Stanley analysts said in a note to clients this week that Wall Street is anxious about Nvidia's pause ahead of the Blackwell launch, even as big tech companies pledge to continue investing tens of billions of dollars this year to build data center infrastructure for AI.

Production of the new Blackwell chips will gradually increase this year. Analysts expect them to be delivered in the fourth quarter. During this period, Citi analysts believe that demand for Nvidia's AI chips will break down.

Amazon and Nvidia declined to disclose the value of the order. Analysts at HSBC estimated that a GB200 chip would cost as much as $70,000, while a full server with the new technology could cost up to $3 million.

AWS will continue to offer other Nvidia chips, including the H100, to its cloud customers. But the move by AWS, one of Nvidia’s largest customers, could worry investors who have already worried that tech companies would hold off on buying while they wait for Blackwell to go public.

For much of last year, Nvidia’s H100 AI chip was in far shorter supply than it should have been, as the launch of OpenAI’s groundbreaking ChatGPT triggered a wave of investment in AI infrastructure from cloud and internet companies, startups, and enterprise buyers. But since early 2024, the long wait for the H100 chip has eased.

Nvidia shares have nearly doubled since the start of the year as investors have become more confident about demand for AI chips, but have struggled to show sustained gains since the release of Blackwell in March.